If you’ve recently checked your bank statement and noticed a charge labelled as “SP AFF*”you may be wondering what it is and where it came from. This mysterious entry has puzzled many bank account owner.

But fear not, financial detectives! We’re here to crack the case of the “SP AFF*” charge on your bank statement and provide you with the information you need to understand and manage it effectively.

What Is the SP AFF* Bank Charge?

SP AFF* charge is not a scam or fraudulent charge. It is a legitimate charge that is associated with a subscription or membership service. SP in SP AFF* stands for “subscription payment,” and the “AFF” stands for “affiliate.”

‘SP AFF*’ charge on your bank statement is typically related to Affirm, a trusted provider of Buy Now Pay Later (BNPL) loans. BNPL service allows you to make a purchase and pay the amount later or split the payment into installments

Affirm is one of the best among other BNPL providers due to its wide range of repayment options and help to manage your finances effectively. By offering different alternatives, Affirm strives to make online shopping more accessible and affordable.

When you see the SP AFF* charge on your bank statement, it means that you’ve made a transaction using Affirm’s BNPL service. The SP AFF* charge acts as a friendly reminder of the financial freedom and convenience offered by Affirm.

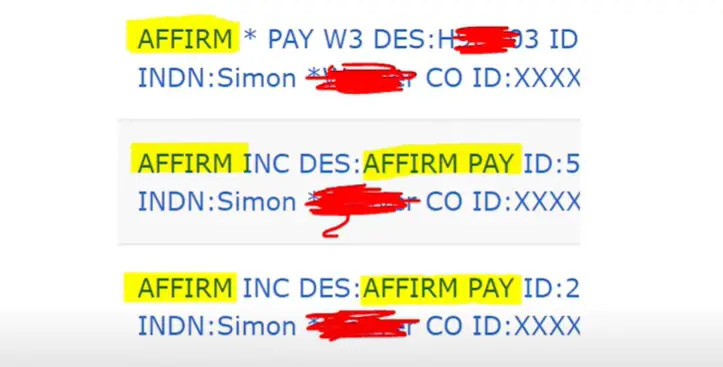

How does the SP AFF* Charge appear on bank statement?

To Identify the SP AFF* charge in your bank or credit card statement, then look for any transactions labeled with “SP AFF*.” These transactions will have specific names associated with them, indicating the nature of the purchase made through Affirm’s BNPL service.

Here are some examples

SP AFF* APPLE STORE:

This transaction name shows that you made a purchase from the Apple Store using Affirm’s BNPL service.

SP AFF* AMAZON:

This transaction name shows that you made a purchase from the Amazon using Affirm’s BNPL service.

SP AFF* BEST BUY:

This transaction name shows that you made a purchase from the BEST BUY using Affirm’s BNPL service It could be any electronic appliances.

SP AFF* FASHION RETAILER:

This transaction name refers to a fashion retailer where you used Affirm’s BNPL service to splurge on a new wardrobe, trendy accessories, or stylish footwear.

SP AFF* TRAVEL AGENCY:

This transaction name shows that you have book a vacation, flights, or accommodations through a travel agency using Affirm’s BNPL service.

SP AFF* FITNESS EQUIPMENT

SP AFF B

AFFIRM PAY

SP AFF FIGS INC

SP+AFF 855-423-3729

SP AFF Gamma Enterprise

SP+AFF AFFIRM

SP AFF San Francisco CA

Purchase SP + AFF

Remember, these transaction names are just examples, and the specific name associated with the SP AFF* charge will vary based on the merchant from which you made the purchase using Affirm’s BNPL service.

you can also read about similar charge labelled as 365 market charge on bank statement.

How do I cancel my subscription or membership?

If you want to cancel your subscription or membership, you should start by identifying the company associated with the SP AFF* charge. This can usually be found by doing a quick internet search of the company name followed by “SP AFF* charge. Once you have identified the company, follow their unique cancellation procedure, this may involve logging into your account on their website or contacting their customer service department.

It’s important to note that some companies may require you to cancel your subscription or membership before a certain date in order to avoid being charged for the next billing cycle.

Can I get a refund for the SP AFF* charge?

Getting a refund for the SP AFF* charge totally depends on the company public policy and terms and condition associated with the SP AFF* charge. It’s best to contact the company directly to inquire about their refund policy.

Preventing Unauthorized SP AFF* Charges

Review BNPL Terms and Condition

You should be knowing all about the Affirm’s terms to understand the repayment schedule, interest rates, and any potential fees.

Monitor Bank Statements

Frequently checking your bank or credit card statements to identify any unexpected SP AFF* charges or any other charges to manage your finances effectively.

Enable Transaction Alerts

Set up transaction alerts to receive notifications about SP AFF* charges and all the other charges.

Secure Your Personal Information

Do not share your sensitive banking details with anyone or on online platforms except secure and trusted platforms.

Contact Your Bank

If you notice any unauthorized or fraudulent charge on your bank statement immediately contact your bank and alert them of this unrecognized activity and provide them all of your banking details. The bank will guide you through the necessary steps to dispute the charge and secure your account.

Conclusion

SP AFF* charge is not a scam or fraudulent charge. It is a legitimate charge that is associated with a subscription or membership service that you have signed up for through a third-party website. To prevent it in future carefully read about company’s public policy before subscribing it, and regularly check your bank statements for any unfamiliar charges.